Market Capitalization: Simple Guide for Everyday Investors

Ever wonder why analysts toss around terms like “large‑cap” or “mid‑cap” when talking about stocks? It all comes down to market capitalization – the quick‑and‑dirty way to measure a company’s total value on the stock market. Knowing this number helps you spot growth opportunities, avoid risky bets, and compare firms across industries without getting lost in jargon.

How Market Cap Is Calculated

It’s easy: take the current share price and multiply it by the total number of shares outstanding. If a company has 10 million shares trading at $20 each, its market cap is $200 million. That’s the snapshot investors use to rank companies from tiny startups to global giants. The calculation updates every time the price moves, so the figure is always as fresh as the market.

Because the formula uses public data, you can find market caps on any finance site, brokerage app, or even a company’s own investor relations page. No need for deep‑dive balance sheets – just the share price and share count.

Why Market Cap Matters to You

Market cap tells you how the market perceives a company’s risk and growth potential. Large‑cap firms (over $10 billion) tend to be stable, pay dividends, and weather downturns better. Mid‑caps ($2‑10 billion) often sit in the sweet spot: enough size for stability but still room to grow fast. Small‑caps (under $2 billion) can explode with growth, but they’re also more vulnerable to market swings.

For investors, this means you can shape a portfolio that matches your risk appetite. Want a steady ride? Load up on large‑caps like the big banks or consumer goods giants. Seeking higher upside? Sprinkle mid‑ and small‑caps that have strong fundamentals and a clear growth story.

Market cap also plays a role in index funds. The S&P 500, for example, is weighted by market cap, so the biggest companies move the index the most. Understanding the weighting helps you gauge why certain news, like a sudden price jump in a mega‑cap tech firm, can shake the whole market.

Beyond stocks, the concept pops up in other areas. The NBA salary cap you read about earlier works on a similar principle – a total limit that teams can spend on player salaries, keeping competition balanced. Real‑estate investors use “cap rates” to measure property returns, which is a cousin of market cap logic.

In practice, start by checking a company’s market cap before you buy. Compare it with revenue, earnings, and debt to see if the price makes sense. If a small‑cap tech startup has a market cap that dwarfs its earnings, ask yourself if the hype is justified or if you’re walking into a bubble.

Bottom line: market capitalization is a quick, reliable yardstick that helps you sort stocks, balance risk, and understand market moves. Keep it in your investing toolbox and let it guide smarter decisions.

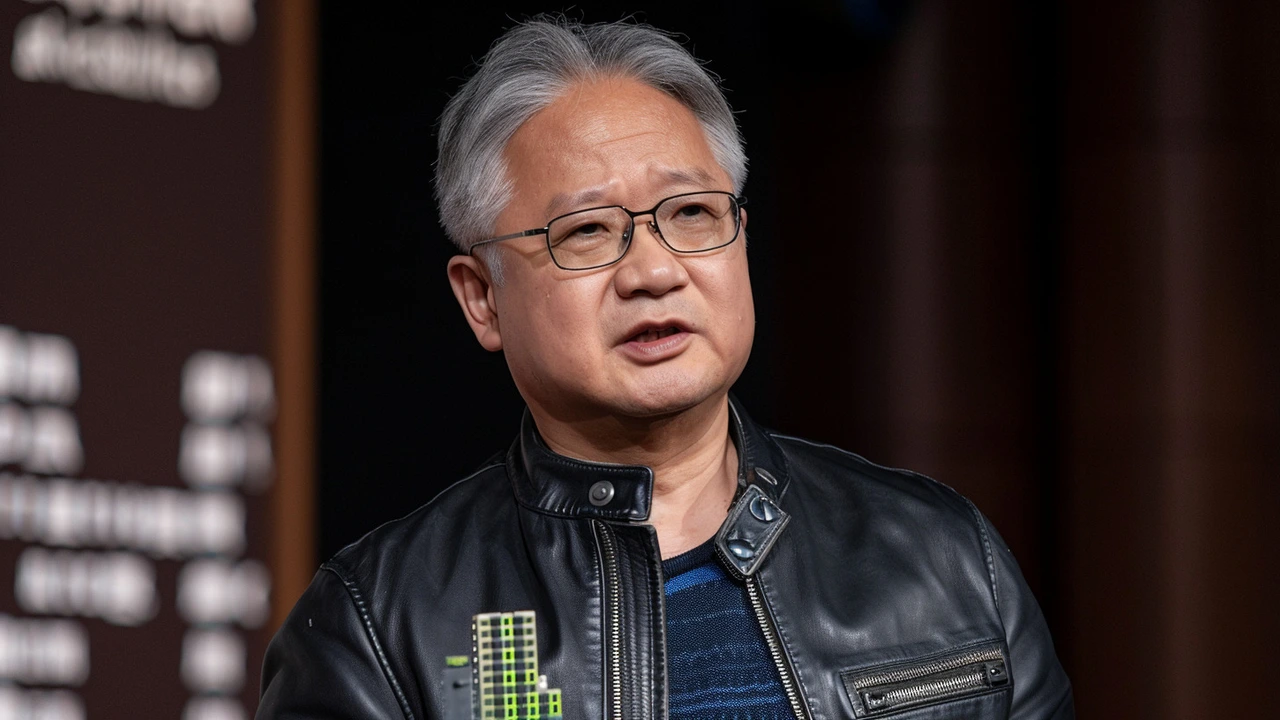

Nvidia Leads the Pack: The Dominant Force in the US Tech Market with Breakthrough in AI

- Jeremy van Dyk

- 11 Comments

Nvidia has overtaken Microsoft to become the most valuable public company in the US, boasting a market capitalization exceeding $3.34 trillion. Nvidia's superior AI chips have been key to this success, outpacing even giant competitors like Microsoft and Apple. The tech industry is witnessing a landmark shift, driven by Nvidia's innovative AI advancements.

Read more